Investors in January quickly realized that the Federal Reserve could put off cutting rates for longer that the market would like and that the market had already priced in. Others focused on the fact that the central bank had already cut rates multiple times in 2023. The moves were enough to support new securitization originations.

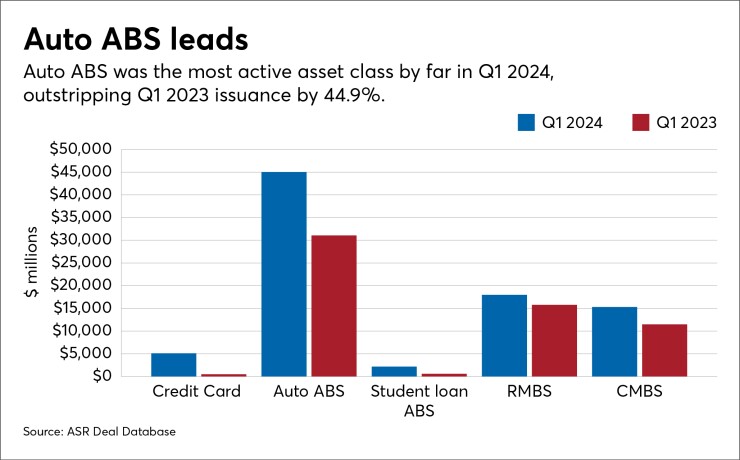

It gave the first quarter a strong start. New asset-backed securities (ABS) business totaled a preliminary $85.6 billion in Q1 2024, representing an increase of 30.5% over the $59.3 billion seen in Q1 2023, according to preliminary figures from the Asset Securitization Report's deal database.

Fed policy supported financing across all sectors of consumer loans, said Tracy Chen, head of global structured credit investing at Brandywine Global, adding that attractive rates also portend strong issuance in 2024.

"The interest rate environment for this year is in a better place than last year, since last October," Chen said. "The rates market has rallied."

The current tally and reporting temporarily excludes the total for collateralized loan obligations (CLOs), due to a gap in comparable figures for the same period last year. CLOs on their own contributed $62.7 billion in new business, according to the database. When CLOs are added, the tally for new securitization business totals $146.1 billion, according to the deal database.

Auto ABS leads consumer assets

New originations rose across all asset classes, although some more than others. Among credit cards, household debt increased tremendously, which worries investors about how lower-income borrowers might weather economic disruptions, said Chen.

Student loan ABS produced at least $2.2 billion in new securitized bonds in the last cycle, an increase over production for the same period last year. Expectations for new issuance are a bit uncertain, given federal loan forgiveness policy.

Retail auto loans and leases have two major strengths that made it the most prolific of asset classes yet again. Auto securitization bond structures are the most user friendly—they have short durations, and they are the most liquid of the consumer asset classes after credit cards, says Chen.

That helped the asset class churn out $45 billion in issuance by March 28, according to the ASR deal database, which easily beat the $31 billion in new securitizations for Q1 2023, and represented a 44.9% increase, the database said.

Fundamentally, auto sales in the first quarter were robust, which probably helped offset some auto price declines that could have imperiled recovery rates.

"Used car prices have been coming down but used car values have still been elevated compared to pre-COVID levels," Chen said.

The bond structures also make the most of such fundamentals, Chen notes. Their short durations should be attractive to investors who expect rates to remain high for several more months this year, she said.

RMBS on solid foundations

When industry observers made yearend predictions for the residential and commercial mortgage-backed securities classes, they expressed some concerns about affordability amid a mixed outlook for the sector.

Those fundamentals were not enough to suppress issuance, though. By ASR's count, new RMBS business totaled $17.9 billion, beating the $15.7 billion seen in Q1 2023.

Chen observed that RMBS delinquency rates are very benign and the amount of accumulated home equity should support high recovery rates, even in the case of defaults.

"The delinquency rates have been less of a concern in the residential RMBS sector, much better than the consumer loans and subprime auto," Chen said.